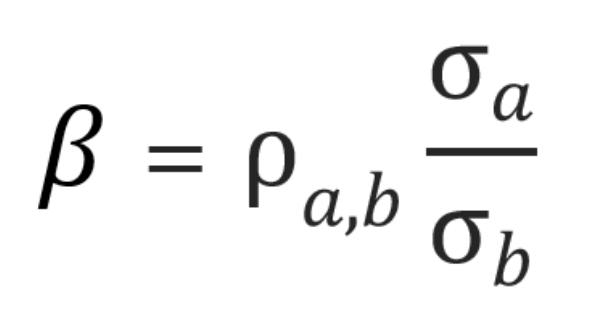

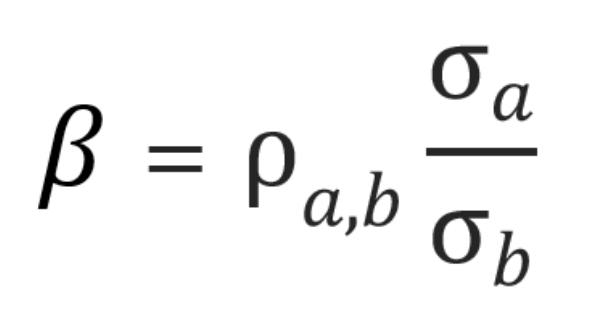

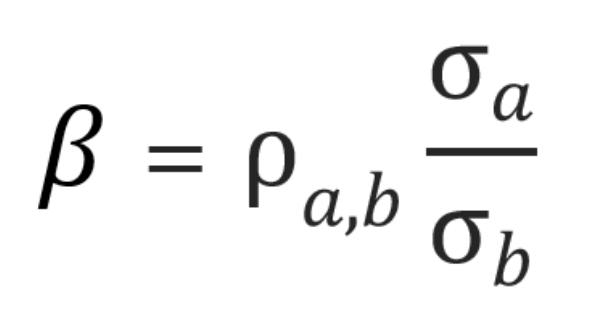

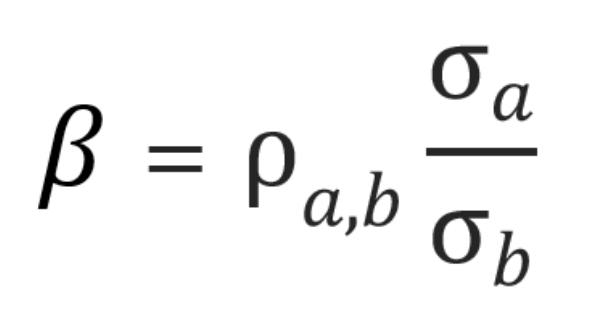

Beta is a measure of a stock’s volatility relative to its market.

Despite ACME’s low beta, the recent drop in its share price coincided with the market slump and therefore many investors lost money.

A beta is used for assessing the market risk of a given stock. If the beta is equal to one, the asset’s price moves up and down in step with the market cycle (as is the case, for example, with cyclical stocks). If it is greater than one, the asset is more volatile than the market. If it is close to zero, the asset has low correlation to the market cycle and may be considered a defensive stock. An asset with a negative beta would be countercyclical, i.e. its price would increase when the market goes down and decrease when the market goes up, although such assets are relatively rare.

Beta je měřítko volatility akcie oproti jejímu trhu.

Navzdory nízké betě společnosti ACME se nedávný pokles ceny akcií kryl s tržním propadem, a mnoho investorů proto přišlo o peníze.

Beta se používá k posouzení tržního rizika dané akcie. Pokud je beta rovna nule, cena aktiva se pohybuje nahoru a dolů v souladu s tržním cyklem (jak je tomu například u cyklických akcií). Pokud je vyšší než jedna, je aktivum volatilnější než trh. Pokud je blízká nule, má aktivum nízkou korelaci k tržnímu cyklu a může být považováno za defenzivní akcii. Aktivum se zápornou betou by bylo proticyklické, tj. jeho cena by se zvyšovala, když jde trh dolů, a snižovala, když jde trh nahoru, ale taková aktiva jsou relativně vzácná.

English Editorial Services’ mission is to assist international businesses and organizations of all sizes to communicate clearly, correctly, and persuasively with their business partners and target audiences.

Simply subscribe to receive our Business Term of the Day at no charge to your inbox each business day, with explanation in English and Czech.

English Editorial Services’ mission is to assist international businesses and organizations of all sizes to communicate clearly, correctly, and persuasively with their business partners and target audiences.

Simply subscribe to receive our Business Term of the Day at no charge to your inbox each business day, with explanation in English and Czech.